Frequently Asked Questions About the Living Trust Plus®

Q: I’m still healthy. Why should I care about avoiding nursing home expenses?

A: Because 70% of Americans who live to age 65 will need long-term care at some time in their lives, 40% of individuals wind up in nursing homes, and because 50 percent of all couples and 70 percent of single persons become impoverished within one year after entering a nursing home. You can't just hide your head in the sand and hope that you are never going to need nursing home care. The best estate plan in the world is useless if you wind up in a nursing home and spend all of your money on long-term care.

Q: What is the Living Trust Plus® and how does it work?

A: The Living Trust Plus® is an irrevocable asset protection trust that you create while you are living, that protects your assets from probate PLUS lawsuits PLUS Medicaid (after 5 years) PLUS Veterans Aid and Attendance for wartime Veterans (after 3 years). You keep the right to live in any trust-owned real estate, but you can not have direct access to principal. You can retain the right receive all ordinary income (interest, dividends, rent, and royalties) from the trust assets, but this is generally not recommended. If either you or your spouse has direct access to principal, the assets in the trust would be deemed "countable" for Medicaid eligibility purposes and would be completely available to almost all other creditors. Prohibiting direct access to principal is the key to why the Living Trust Plus® works -- for general creditor protection and for Medicaid asset protection.

Q: Does the Living Trust Plus® completely avoid probate, just like a regular revocable living trust?

A: Yes, if properly funded. So long as all assets are either titled in the Living Trust Plus® or name the Living Trust Plus® as the beneficiary on death, probate will be avoided.

Q: Does the Living Trust Plus® completely avoid probate, just like a regular revocable living trust?

A: Yes, if properly funded. So long as all assets are either titled in the Living Trust Plus® or name the Living Trust Plus® as the beneficiary on death, probate will be avoided.

Q: You say I can't have direct access to my principal. Does this mean I may have indirect access to the trust principal?

A: Possibly. There are two ways that you can have possible indirect access to the trust principal. The first way is that the trust is written so that the Trustee has the ability to make distributions of principal to the trust beneficiaries, who are typically your adult children. If the Trustee distributes principal to a trust beneficiary, that beneficiary can then voluntarily return some of that principal to you or use it for your benefit. There must not be any prior agreement that a trust beneficiary will return some of that principal to you or use it for your benefit. The second way for the Settlor to get at the trust principal is for the trust to be terminated, as explained below.

Q: I thought the Living Trust Plus is an irrevocable trust -- how can an irrevocable trust be terminated?

A: The Living Trust Plus® is an irrevocable trust, and many people, including lots of good estate planning attorneys, think that means the trust can never be revoked. But the fact is that the term "irrevocable" means only one thing - that the trust can not be unilaterally revoked by the creator of the trust. Although the Living Trust Plus® is irrevocable and can't be revoked unilaterally by the settlor, under common law and under the Uniform Trust Code, a non-charitable irrevocable trust can be modified, terminated, or partially terminated upon the consent of the trustee and all trust beneficiaries.

Q: What type of clients use the Living Trust Plus® ?

A: Typical clients are in their mid-60s to mid-80s, retired, and worried about the potential catastrophic cost of long-term care; often they have dealt with a family member who has needed nursing home care and was forced to go broke; typically these client want to protect the assets that they've spent a lifetime working for, saving for a rainy day. The rainiest possible day for most people is the day they start needing nursing home care, and if they want to truly protect their nest egg and have it actually benefit them when the time comes, they know they need to do something to shelter that money. The Living Trust Plus®, for many people, is the best way to do that.

Q: What about Long-Term Care Insurance?

A: Long-term care insurance is great if you can qualify for it and can afford it, as it covers both the assisted living "level of care" and the nursing home "level of care," whereas Medicaid (the main benefit that can be achieved by protecting your assets via the Living Trust Plus) only covers the nursing home level of care; however, the Living Trust Plus can also allow you to obtain assisted living coverage through the Veterans Aid and Attendance benefit if you're a qualified veteran.

The assisted living "level of care" is needed when you need assistance with 2 or 3 of the 6 Activities of Daily Living (ADLs); these 6 ADLs are generally categorized as: bathing; dressing; eating; transferring (moving from bed to chair, chair to standing, etc.); toileting (physically getting to the toilet, using it appropriately, and cleaning up appropriately); and continence (retaining control of your bladder and bowel or being able to clean up after yourself if you have occasional "accidents"). The assisted living level of care can take place at home or in an assisting living facility.

The nursing home "level of care" is generally needed when you need assistance with 4 or more of the 6 Activities of Daily Living, but a moderate to severe cognitive impairment (especially when coupled with needing assistance or guidance or queuing for ADLs) can also lead to needing the nursing home "level of care." The nursing home level of care can take place at home or in an nursing home.

Many Living Trust Plus® clients have long-term care insurance, but many don't because can't afford it or have one or more medical conditions that prohibit them from getting it. For many clients, the Living Trust Plus® is the best possible alternative to purchasing long-term care insurance, but many clients have the ideal combination of both long-term care insurance and the Living Trust Plus, keeping in mind that most long-term care insurance policies provide only limited coverage for a limited period of time, often 3 years or 5 years. Occasionally, clients have such good long-term care insurance -- a very high daily coverage amount along with lifetime/unlimited coverage benefits, that they have no need for the Living Trust Plus.

Q: What assets can go into the Living Trust Plus®?

A: The main types of assets that should be funded into the Living Trust Plus® are the primary residence, any secondary residence, investment real estate, any non-retirement financial investments, ordinary bank accounts, and life insurance.

Q: Are their any capital gains tax implications for selling my home if I have titled my home into my Living Trust Plus®?

A: No. The capital gains tax implications of selling a home from the trust are no different than if you sold it yourself as an individual. The Living Trust Plus® does not affect the $250k / $500k capital gains exclusion available to each owner on the sale of a primary residence.

Q: Are their any other tax implications in connection with the Living Trust Plus®?

A: No. The main version and the income only version of the Living Trust Plus® are completely tax neutral - i.e., they will have no effect on your income tax, capital gains tax, or estate tax. Although a separate trust tax return may have to be filed, it will be information only, as the trust is a "grantor-type" trust that does not itself pay taxes. There is a veterans version which involves the use of two trusts, a Residence Trust which is a Grantor trust for the house to preserve the $250k / $500k capital gains exclusion, and an Investment Trust to hold financial accounts, where the income is taxed to the beneficiaries.

Q: What About IRS Revenue Ruling 2023-2? Why It Does Not Affect the Living Trust Plus®

A: Clarifying Misconceptions About Step-Up in Basis and Irrevocable Trusts

Since the IRS issued Revenue Ruling 2023-2 in March 2023, many articles — including some written by attorneys and CPAs — have spread the mistaken idea that no irrevocable trust allows a step-up in basis at death. This misunderstanding has led to confusion and concern among clients who have already created certain types of asset protection trusts, particularly those using our Living Trust Plus® Asset Protection Trust.

Let’s be clear: Revenue Ruling 2023-2 was a confirmation of existing law and changed nothing about the tax treatment of the Living Trust Plus.

What the Ruling Actually Says — and What It Doesn’t

Revenue Ruling 2023-2 confirmed (did not change) a longstanding principle of tax law: if an asset is not included in your taxable estate at death, then it does not receive a step-up in basis. The ruling addressed a specific type of irrevocable trust where the assets were intentionally removed from the taxable estate — typically done by high-net-worth individuals for estate tax avoidance — and concluded that, under those conditions, no step-up in basis applies.

Again — his is not new law. It simply reaffirms what has been understood by experienced estate planning and elder law attorneys for decades:

A step-up in basis under IRC § 1014 only applies to assets that are included in the decedent’s estate for federal estate tax purposes.

If the asset is not includible under IRC §§ 2036 or 2038 — because the decedent retained no incidents of ownership or control — then it is not eligible for the step-up.

The ruling does not affect irrevocable trusts where the assets remain part of the grantor’s estate, as is the case with the Living Trust Plus.

The Living Trust Plus® Has Always Been Estate-Includible

Unlike high-net-worth planning tools designed to remove assets from the estate for federal estate tax purposes, the Living Trust Plus was never created with that goal in mind. Its purpose is entirely different — it is designed to protect assets from Medicaid and long-term care spend-down requirements, not to avoid estate tax.

Because of that fundamental distinction, the Living Trust Plus has always been structured as follows:

It is a grantor trust for income tax purposes — meaning you, the person setting it up, continue to report income from trust assets on your personal tax return.

It is includible in your estate for estate tax purposes under IRC § 2036(a)(2) because you retain the power to change beneficiaries, sometimes the right to receive income, and sometimes the right to live in the trust-owned home.

As a result, assets in the Living Trust Plus receive a step-up in basis at your death — just as if they had remained in your name.

This has always been the case. Revenue Ruling 2023-2 does not change this structure, nor does it cast doubt on the well-established treatment of grantor-type irrevocable trusts that are estate-includible.

Why So Many Other Articles Are Misleading

Unfortunately, many of the articles circulating online are based on a flawed assumption: that all irrevocable trusts are designed to remove assets from the estate. That may be true in the world of ultra-high-net-worth estate planning — where the goal is to reduce or eliminate estate tax — but it is not true for Medicaid-focused planning or for the Living Trust Plus.

These misleading articles make several incorrect generalizations: (1) they treat all irrevocable trusts as if they are the same — failing to recognize that there are dozens of distinct types, each with different drafting goals, tax treatments, and estate inclusion consequences; (2) they suggest — without basis — that Revenue Ruling 2023-2 is a change in the law, when in fact it is just a reiteration of a long-standing rule.

The Living Trust Plus was never designed for high-net-worth individuals looking to avoid estate tax. It was built for average Americans — middle-class families who want to preserve their hard-earned assets from the devastating costs of long-term care. The trust structure deliberately preserves income tax advantages, including the step-up in basis.

The Bottom Line: Nothing Has Changed for Living Trust Plus Clients

If you have a Living Trust Plus® already in place — or are considering setting one up — here’s what you need to know:

Revenue Ruling 2023-2 does not affect you. Your trust assets are still includible in your estate, so they still receive a step-up in basis at death. You still retain the full income tax benefits of grantor trust treatment. You still have a powerful legal structure to protect your assets from Medicaid and long-term care spend-down requirements.

In short, there is no need for concern — but there is a need to understand the difference between irrevocable trusts designed for asset protection and those designed for estate tax reduction. The Living Trust Plus is part of the former category, and it was carefully crafted to preserve the step-up in basis while still offering the protections you need.

Q: Does a married couple create one joint Living Trust Plus® or two separate trusts? And what happens on the death of the first spouse?

A: Most married couples create one joint Living Trust Plus® but some create two separate trusts. Which way depends on multiple considerations, including whether or not the trustees and beneficiaries are identical for both spouses. On the death of one spouse, typically nothing changes, as both trusts were already irrevocable prior to death. For married couples with estates larger than the Estate Tax exemption equivalent amount ($11.2 million per spouse in 2018), the Living Trust Plus® is designed to take advantage of both exemptions.

Q: Are there any assets that can’t go in to the Living Trust Plus®?

A: The assets that shouldn't be transferred into the Living Trust Plus®are your qualified retirement plans (e.g., IRAs and 401(k) plans) and your primary checking account. Most states treat qualified retirement plans as countable resources for Medicaid, so if you want to protect the assets in your qualified retirement plan from Medicaid by using the Living Trust Plus® you will need to cash out your retirement plan first, and pay any income taxes that are due as a result of terminating the plan. We usually do not put annuities into the trust either, but it depends on the type of annuity.

Q: What if a big percentage of my assets are tied up in a qualified retirement plan (e.g., IRAs and 401(k) plans)? Can I still do the Living Trust Plus®?

A: Although qualified assets can't be transferred into the Living Trust Plus® because of IRS regulations, it often makes very good sense to liquidate your qualified plans and transfer the after-tax balance into the Living Trust Plus® Asset Protection Trust. Although "conventional wisdom" typically recommends postponing paying taxes as long as possible, every rule has its exception. For example, converting funds from a traditional IRA to a Roth IRA has three significant benefits:

- You can avoid future mandatory disbursements from your IRA;

- Avoiding future mandatory distributions means your money can grow for a longer time, and will grow tax fee in a Roth IRA.

- By converting funds now, you owe tax at today’s ordinary income rates, and will never again have to pay income tax on these funds, or the growth in these funds.

No one knows when the federal government is going to raise tax rates, or whether your beneficiaries will be in a higher tax bracket then you are, but if either or both of these scenarios becomes true, then converting now makes good sense. That is because paying the tax bill at your lower rate will ultimately produce more cash for your heirs than if you left the money to your heirs in a traditional IRA and they are forced to pay ordinary income tax on the distributions over a period of 10 years following your death, pursuant to the SECURE Act. Per this article, “Americans are paying the smallest share of their income for taxes since 1958,” and the tax rates were further reduced in 2016, and are planned to increase in 2026 back to their pre-2016 rates, as further explained here.

These same 3 exceptions, and a fourth and much greater exception, applies to moving funds from a traditional IRA into an after-tax investment inside the Living Trust Plus®:

- You avoid future mandatory disbursements from your IRA;

- Avoiding future mandatory distributions of principal means your money can grow for a longer time and, if put into tax-free investments, will grow tax free inside the Living Trust Plus®.

- By converting funds now, you owe tax at today’s ordinary income rates, and will never again have to pay income tax on these funds.

-

Lastly, and most importantly, transferring assets from a traditional IRA into the Living Trust Plus® protects those assets, after 5 years, from ever having to be paid to the nursing home for long-term care. Given that 70% of adults over the age of 65 will need long-term care, this asset protection feature of the Living Trust Plus® is often more significant than the tax savings that might occur by leaving money in a traditional IRA which is, in most states, completely exposed to nursing home expenses.

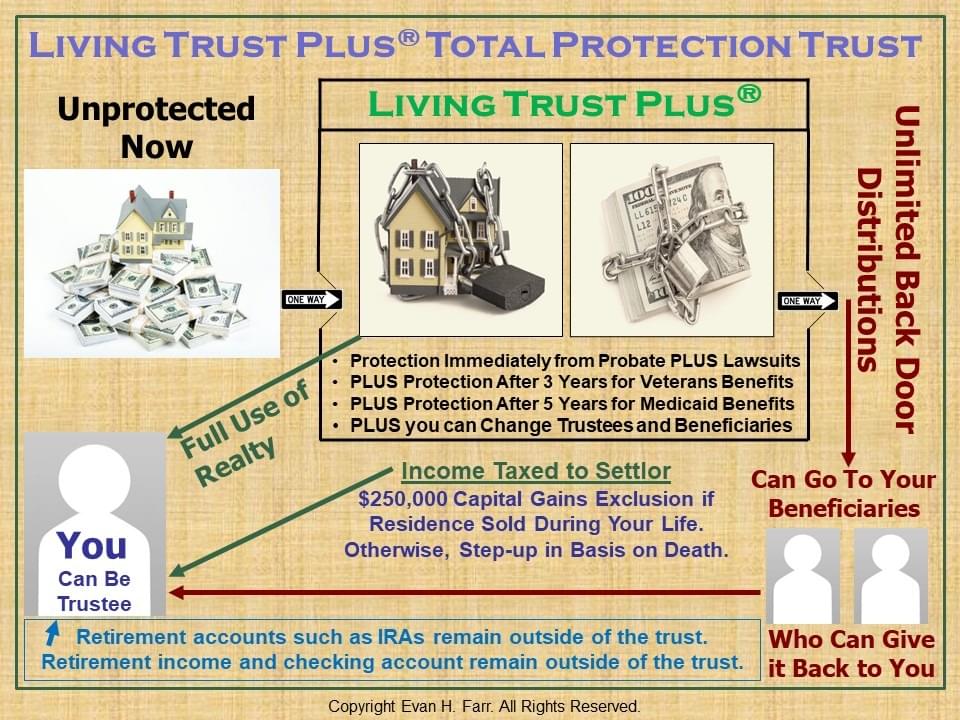

Q: Are there diagrams showing how the different versions of the Living Trust Plus® work?

A: Below are three diagrams showing how the three different versions of the Living Trust Plus® operate.

- Living Trust Plus® Total Protection Trust

- Medicaid Asset Protection Trust

- Veterans Aid and Attendance Asset Protection Trust

-

Veterans Pension Asset Protection Trust

In this first version, which is the one most commonly used, the creator of the trust retains no ability to receive distributions directly from the trust. This version is simpler to operate mechanically and for tax purposes than the second version, and works for protecting assets in connection with Medicaid and for wartime Veterans desiring to protect assets in connection with the Veterans Aid and Attendance Benefit.

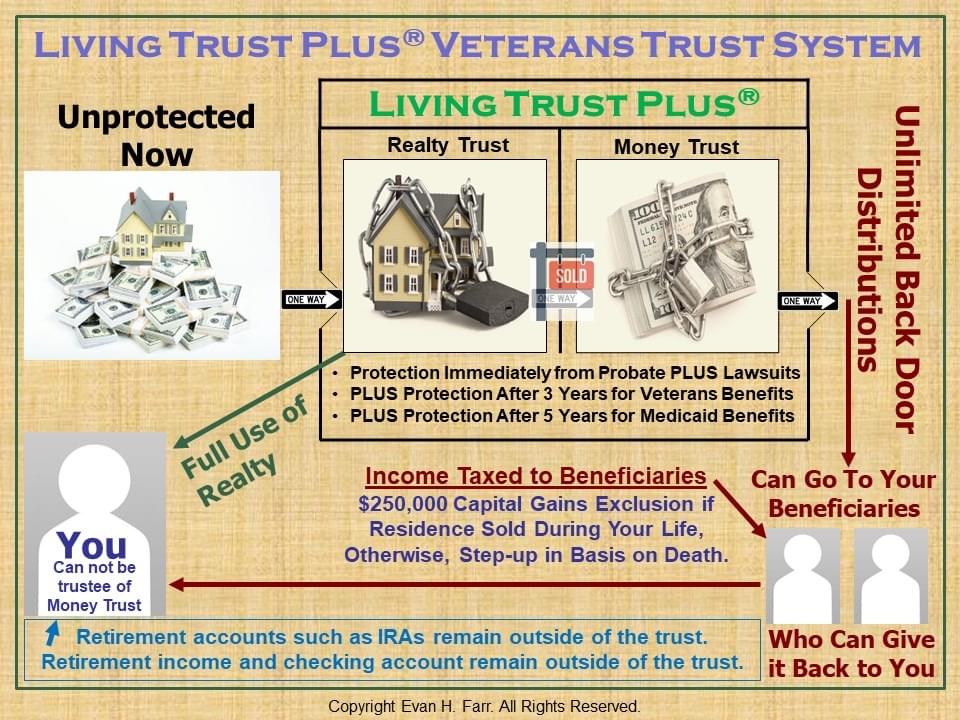

- Medicaid Asset Protection Trust (2-Trusts)

- Living Trust Plus® Veterans Version (2-Trusts)

- Veterans Pension Asset Protection Trust (2-Trusts)

-

Veterans Aid and Attendance Protection Trust (2-Trusts)

This second version is a special veterans version that involves the use of two trusts, a Residence Trust which is a Grantor trust for the house to preserve the $250k / $500k capital gains exclusion, and an Investment Trust to hold financial accounts, where the income is taxed to the beneficiaries This two-trust approach, while more complicated, avoids the VA seeing "phantom income" on the Settlor's tax return and counting that phantom income as part of the Aid and Attendance applicant's income and net worth.

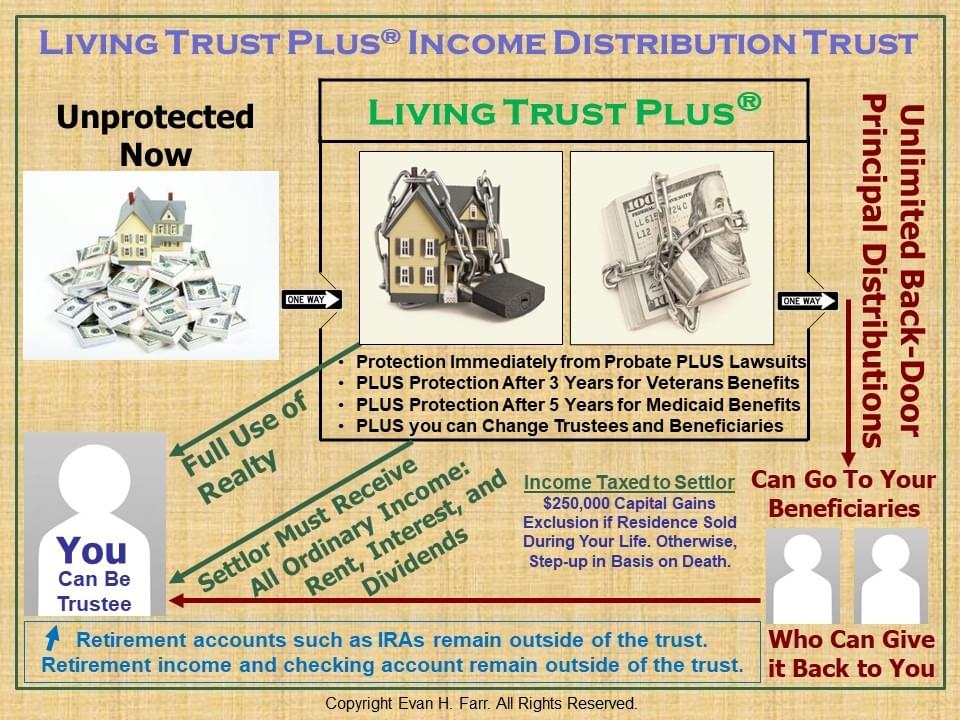

- Medicaid Asset Protection Trust

- Medicaid Income-Only Trust

- Living Trust Plus®Income Only Trust

-

Living Trust Plus®Income Distribution Trust

This third version allows the creator of the trust the optional right to receive distributions of ordinary income directly from the trust. This second version, sometimes called an "income-only trust," protects your assets from probate PLUS lawsuits, PLUS nursing home expenses (which can be paid by Medicaid), but does NOT protect your assets in connection with the Veterans Aid and Attendance Benefit; this version is used primarily by clients who rely on rental income.

Elder Law Institute for Training and Education, LLC.

© 2009 - 2024 All Rights Reserved

© 2009 - 2024 All Rights Reserved

Privacy Policy - Terms & Conditions - Disclaimer